Three Developers Partner to Launch Yorkville High-Rise

SHANE DINGMAN REAL ESTATE REPORTER,

AS SEEN IN THE GLOBE & MAIL

Three major real estate developers in the Greater Toronto Area are teaming up for what they believe could be the last high-rise condominium to be built on Yorkville Avenue, in a project that reflects many of the risks facing large-scale developers.

“This is not a business any more for the faint of heart or short of capital,” said Ed Sonshine, chief executive of RioCan, Mr. Sonshine said Riocan has a 50-per-cent stake in the project branded 11 Yorkville. It took three years and six separate transactions to assemble the land for proposed 62-storey building. “Howard [Sokolowski of Metropia, which has a 25-per-cent share] brought me the opportunity. It was a risky process: You had to buy the buildings one by one, it was a fairly risky venture.

“Typically we start with land we already own, only two times has Riocan has done it [assembled land] in the last decade. I eventually said to Howard: if this doesn’t work out it’s not going to kill Riocan, but it might kill you!”

The proposed development includes a park that will provide a pedestrian throughfare from Cumberland Street and Yorkville Avenue.

RIOCAN LIVING/METROPIA/CAPITAL DEVELOPMENTS

Mr. Sokolowski, a 35-year veteran of residential developments (first in low-rise with Tribute Communities and now with condo construction at Metropia) saw it as an opportunity to build something special, on a site that’s also likely to maximize the rewards. “This is up there with some of my very interesting projects. … I’m only interested in doing unique projects now,” he said. He said Tribute’s calling card was “full-fledged communities” of 1,000 housing units or more, and at Metropia he has continued to search for that kind of neighbourhood defining scale. “While Yorkville is a single tower, it’s a very large tower. It’s is the highest-end project that Metropia has done in high-rise world, Yorkville commands a different level of finish and spec.”

The plans hinged on the final and most expensive piece of land the partners were able to acquire, 21 Yorkville, which will allow for the creation of a narrow park, gifted to the city, that will create a pedestrian corridor between Cumberland and Yorkville.

“This is the most expensive land, on a per-square-foot basis, that we’ve purchased,” said Todd Cowan, co-founder and managing partner of Capital Developments, which joined the project midway through the acquisition phase. “When we looked at this site, this is probably the last tower site in one of the greatest tower addresses in all of Canada … it’s a once-in-a-lifetime opportunity.”

The partners were unwilling to say how much they paid for the assembled land, but data from market analysts Altus Group suggests it will have likely cost the trio close to $130-million.

The combination of heritage features and existing uses on the other Yorkville Avenue parcels is what convinced Mr. Sokolowski that this could be the last high-rise-development spot on the street.

“It’s hard to substantiate that comment – you can never say never,” said Ray Wong, vice-president, data operations, data solutions at Altus. According to Mr. Wong, Altus rates Yorkille as one of the priciest areas to develop in the country. Altus calculates that land was appreciating rapidly as the group worked: Yorkville land sales doubled from $131 a buildable square foot in 2014 to $271 a square foot in 2018 (at the same time, the Toronto-wide average went up just 85 per cent to $124 a square foot from $67). All of which means a future developer, if determined enough, might find a way to build another tower. “It takes a certain amount of time and patience, but it probably can be done,” he said.

Along with condo units and retail space, the tower will feature rental apartments.

RIOCAN LIVING/METROPIA/CAPITAL DEVELOPMENTS

The condo units themselves will likely more than pay for the hefty upfront costs, but the site will also feature some flagship retail space for Riocan to manage, as well as 81 rental apartments that have to be replaced (the current proposal is that 20 of those units be affordable).

The average price of homes sold in these area codes is $1.6-million, according to the Teranet-National Bank House Price Index. 11 Yorkville is projected to have 593 apartments available, from 400 to 1,140 square feet. Although pricing per square foot has not been announced, Mr. Cowan said there will be units available for less than $1-million.

“Yorkville is the best street in Canada in terms of aspirational luxury living,” Mr. Sonshine said. “I’m not kidding myself; a large number of the buyers are going to be investors who are going to rent it out.”

One area where the partners may have some disagreement is on the question of how those investors might rent those units out – by long-term lease, or short-term via such sites as Airbnb.

“In my opinion, [Airbnb] cheapens the building,” Mr. Sonshine said. He noted that a nearby building where he owns a condominium apartment recently amended its bylaws to ban short-term operators. He wouldn’t be opposed to barring rentals shorter than six months from the declaration documents.

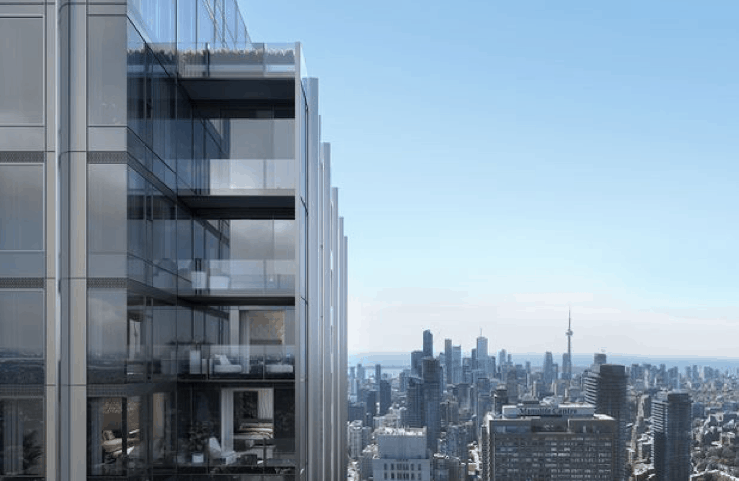

From its Yorkville perch, the building will have views to the downtown core.

RIOCAN LIVING/METROPIA/CAPITAL DEVELOPMENTS

“I’m not against Airbnb,” said Mr. Cowan, who nevertheless felt as though 11 Yorkville wouldn’t be a hotspot for the service. “Me, personally … I don’t believe in a building at this level of finish and level of prestige you’re going to see a lot of Airbnb.”

Mr. Sokolowski is the most tolerant: “We’ve taken a position [that] it’s not our call … we’ll leave that up to the ultimate residents of the building.”

The other hot-button issue in the city is condo cancellations and construction costs, both of which are issues the partners have been working to solve before opening any units up for sale.

“Cost growth is pretty unprecedented … I, personally, have not seen inflation in a market like this before,” said Mr. Cowan, who says the price inflation is worse even than the post-communism construction boom in Central Europe (of which he had direct experience). “We’re very well along [on Yorkville], the construction drawings are already advanced, we’re already tendering for some construction sub-trades.”

“My partners would never consider going to the market until we had a real handle on what our construction costs would be,” Mr. Sokolowski said. “When a project doesn’t go ahead – and they sold units to purchasers – it’s a stain on the industry. I look at it with some disdain; I’m not going to pass judgment, but it’s not going to happen on my watch.”

Source: The Globe And Mail